Cannabis Business Insurance

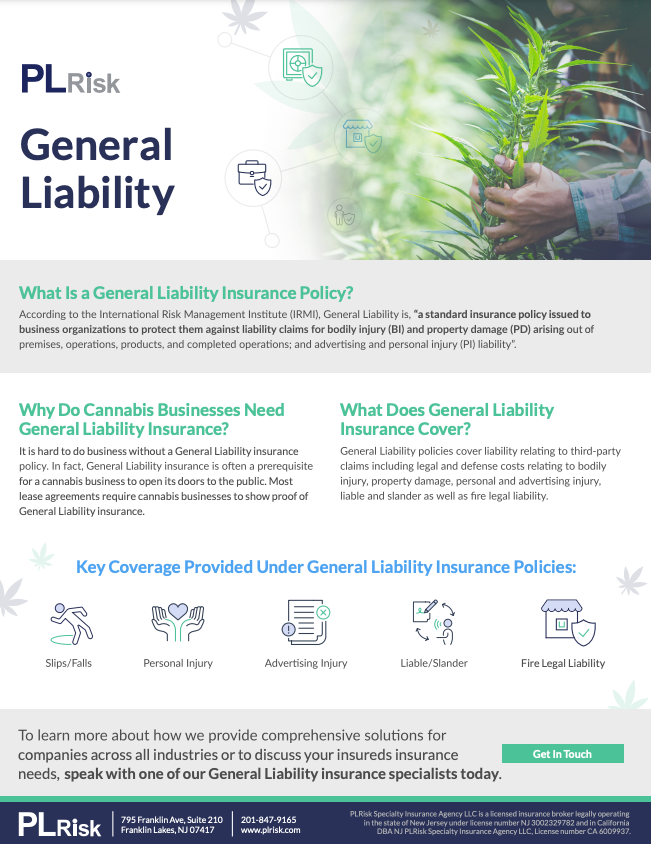

General Liability

According to the International Risk Management Institute, General Liability is “a standard insurance policy issued to business organizations to protect then against liability claims for bodily injury (BI) and property damage (PD) arising out of premises, operations, products, and completed operations; and advertisng and personal injury (PI) liability.”

A Peril is a cause of loss.

A Peril is a cause of loss. Typically, people think of wind, hail, and fire as being covered causes of loss. The types of perils a business is insured for will be listed on the declarations page and will be determined by the type of loss form purchased by the Insured business.

Why Do Cannabis Businesses Need General Liability Insurance?

It’s hard to do business without a General Liability insurance policy. In fact, General Liability insurance is often a prerequisite for a cannabis business to open its doors to the public. Most lease agreements require cannabis businesses to show proof of General Liability insurance.

Get the Cannabis General Liability Insurance Guide

What Does General Liability Insurance Cover?

General Liability policies cover liability relating to third-party claims including legal and defense costs relating to bodily injury, property damage, personal and advertising injury, libel and slander as well as fire legal liability.

Key Coverage Provided Under General Liability Insurance Policies:

Slips/Falls

Personal Injury

Advertising Injury

Libel/Slander

Fire Legal Liability

Let’s talk about your General Liability insurance needs. Contact a cannabis industry insurance expert today.

DOWNLOAD APPLICATIONS

FILE A CLAIM

CLAIM SCENARIOS

FAQs

INDUSTRY TOOLS

FREE CYBER HOTLINE

GET APPOINTED

TITLE AGENTS &

MORTGAGE BROKERS

REAL ESTATE

LEGAL

MEDIA

ARCHITECTS & ENGINEERS

FINANCIAL INST.

CONSULTING

MISC. SERVICES

HEALTHCARE

MEDICAL

INSURANCE

TECHNOLOGY

SPACs

PRODUCTS OVERVIEW

Errors & Omissions

EPLI

Directors & Officers

Fiduciary Liability

Commercial Crime

Cybersecurity

MERGERS & ACQUISITIONS OVERVIEW

Reps

and Warranties