Cannabis Business Insurance

Cyber Liability

What is Cyber or Privacy Liability Insurance?

Cyber liability insurance provides coverage for the costs associated with the unauthorized access, misuse, loss, or theft of data including personal identifiable information, sensitive health information, proprietary data and financial information stored in electronic or physical format. The rise in ransomware attacks has lead to an increase in underwriting scrutiny and increases in premiums and retentions across the board.

A cyber policy will not only help protect your client’s balance sheet but also provide access to resources, vendors and breach coaches at pre-negotiated rates.

What Does A Cyber Liability Policy Cover?

A cyber liability policy covers the defense costs associated with responding to data breaches, ransomware attacks, network outages and other privacy/network security related incidents at either the insured or vendor level. This typically includes but is not limited to coverage for the following:

Third Party Coverages

- Network Security & Privacy Claims

- Regulatory Investigations, Fines and Penalties

- Media Liablity Claims

- Payment Card (PCI-DSS) Assessment Expenses

- Breach Management Expenses

First Party Coverages

- Business Interruption/ Contingent BI

- Ransomware/Cyber

- Digital Asset Retrieval/Systems Restoration

- Court Attendance Costs

- Social Engineering/CyberCrime

- Reputational Loss Coverage

- Breach Response and Remediation Expenses

- Systems Failure/Contingent Systems Failure

Other Enhancements or Sublimits of Coverage That Can Be Included

- Biometric Data -Cryptojacking

- Invoice Manipulation

- Voluntary Notification

- Contingent Bodily Injury

- Criminal Reward Expenses

- Preventative Shutdown

- Bricking/Hardware Replacement

GET THE GUIDE

Cyber Liability Insurance for Cannabis Businesses

Claim Scenarios

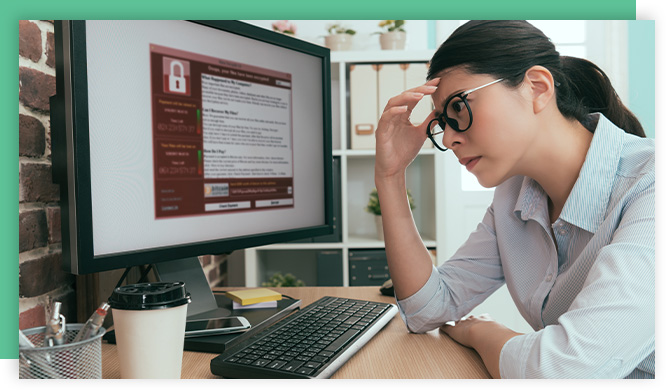

Ransomware

A school district discovered that it was the victim of a ransomware attack when its servers became unresponsive. In addition to encrypting the network, the threat actors also exfiltrated student data and demanded a ransom to prevent the publication of student records on a dark web “shaming site.” Further investigation revealed that backups had been corrupted. The decryption key was ultimately obtained through payment of a $200,000 ransom.

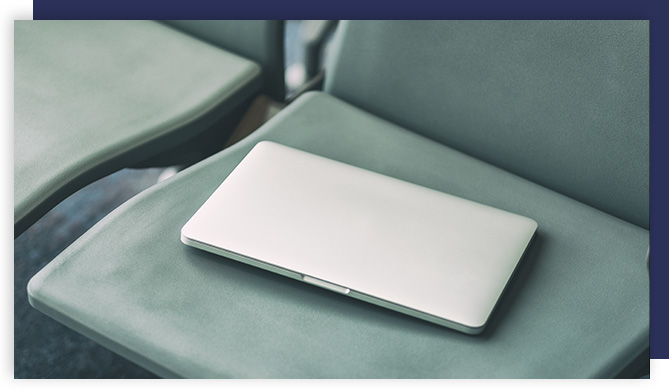

Lost Data

An employee’s company laptop was inadvertently left on a train. The laptop contained customers’ private financial information. The company had to pay to notify their customers that their private financial information was no longer secure. Their customers sued the company for damages resulting from their failure to protect their private financial information. The notification costs and settlement totaled $350,000.

Network Security

An employee inadvertently downloaded a destructive computer virus onto the company’s network, resulting in widespread data loss and transmission of the virus to a client’s computer network. The client sued the company, contending they should have prevented transmission of the virus. Damages of $750,000 were sought for the lost data and economic loss caused by the network security breach.

Consult With an Expert

To learn more about Cyber Liability Insurance or to discuss comprehensive solutions for your insurance needs, connect with one of our insurance specialists today.

DOWNLOAD APPLICATIONS

FILE A CLAIM

CLAIM SCENARIOS

FAQs

INDUSTRY TOOLS

FREE CYBER HOTLINE

GET APPOINTED

TITLE AGENTS &

MORTGAGE BROKERS

REAL ESTATE

LEGAL

MEDIA

ARCHITECTS & ENGINEERS

FINANCIAL INST.

CONSULTING

MISC. SERVICES

HEALTHCARE

MEDICAL

INSURANCE

TECHNOLOGY

SPACs

PRODUCTS OVERVIEW

Errors & Omissions

EPLI

Directors & Officers

Fiduciary Liability

Commercial Crime

Cybersecurity

MERGERS & ACQUISITIONS OVERVIEW

Reps

and Warranties